The Return to Real Wealth

- downstreamwealth

- Apr 24

- 5 min read

Both sides of the tariff debate (those in favor & those opposed) are missing the big picture. The individual tariff rates are virtually meaningless. Once you look between the lines and study economic history, you'll see that these, combined with other rhetoric from the Trump administration, are signaling a new American era of wealth building. These tariffs are much more about a deeper shift away from an unsustainable consumption-based, debt-fueled economy. What's coming is a return to saving, production, and financial sovereignty - both on the national and individual levels.

How We Got Here: The Consumption Trap

Following WWII, the United States experienced an economic boom, largely due to the rebuilding demands from war-torn European and Asian nations. With millions of working age males returning home, the U.S. produced massive amounts of military equipment, materials, vehicles, and electronics—driving income and a large trade surplus. Simply put—we produced more far more than we consumed.

Then, the Federal Reserve and U.S. Treasury began punishing savers by lowering interest rates to finance war debt. America ramped up consumption and continued heavy government spending through the '60s to fund the Vietnam War and Great Society programs like Medicare, Medicaid, Education, and the War on Poverty.

Under the new Bretton Woods system, foreigners held dollars convertible to gold. As U.S. inflation surged from money printing, foreign nations began converting dollars to gold, fearing dollar devaluation. Then, in 1971, Nixon ended the dollar’s gold convertibility, and inflation soared. By then, our trade surplus had flipped to a trade deficit.

The U.S. then shifted its focus. To sustain government spending and consumer demand, we embraced globalization. But this wasn’t organic free trade—it was engineered. Over decades, the U.S. formed alliances with nations like Saudi Arabia and China. The idea: if others produce what we need, we don’t have to save or manufacture—we just consume.

In return, these nations agreed (either explicitly or implicitly) to recycle their dollars into U.S. Treasuries, helping fund America’s deficits. Foreigners saved and produced, while America borrowed and bought. But repeated inflationary Fed policies devalued those Treasuries, and foreign nations learned a hard lesson. They began shifting to assets that preserved value: gold, U.S. equities, real estate, farmland, and energy.

Their wealth soared. Ours—based on debt-fueled consumption—declined. U.S. jobs were outsourced, wages stagnated, and inflation crushed the American middle class. A family once supported by one salary in the '50s now needs two or more. China runs a $1T trade surplus. The U.S.? A $1.2T deficit. We’ve become addicted to foreign goods and borrowed prosperity.

Enter Say's Law: Wealth Comes from Production

Through the "petrodollar" system and the U.S.'s invitation to China, America tried to circumvent Say's Law, which posits that the value of goods and services any group of people can purchase in aggregate is equal to the market value of what they supply in aggregate. In other words, we produce in order to consume.

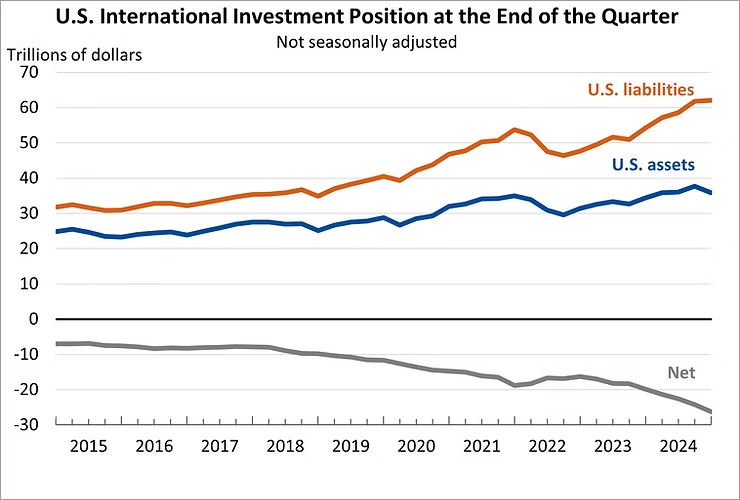

Virtually everyone fails to see the cost of the U.S. government's intervention in free markets. They look at cheap consumer goods and assume everyone must be better off. However, our consumption isn't based on an increase in real income that fueled savings. Our debt is at record levels and skyrocketing. From Say's Law, we can infer that if we're spending without first saving and producing, there MUST be a cost, and that cost, aside from the loss of purchasing power for families is our Net International Investment Position (NIIP). Since 2015, the national debt has soared by about $18T. Coincidentally (or not), our NIIP has declined by $18T.

Here's the American economy in a nutshell: We print money (spurred by artificially low interest rates), money is given to people via loans or government handouts, we spend that money overseas, and foreigners use those dollars to buy up real and valuable American assets. Warren Buffett and Charlie Munger warned about this 20 years ago. And, because GDP (the number one metric for American wealth, which is 70% consumption) and the stock market (owned primarily by the top 1% of Americans and foreigners) have increased, policymakers sit back and tell you that the American economy is strong. But, people are really feeling the pain and the anxiety.

Why This Matters Now

Our national debt is unsustainable. Foreigners are refusing to continue importing our inflation (purchasing U.S. Treasury securities). Instead, they're "importing" our real assets, which poses a national security risk and makes everything else more expensive for Americans. As a result, interest rates are now climbing again as government spending continues to increase. While Trump may back down on his tariffs, this shock is going to push foreigners to reduce their reliance on American imports.

The tariffs should be thought of as a wake-up call for Americans. We are far too reliant on debt to consume. There's a cost to running trade deficits for decades. The only way for America to rebound is by producing, and now that we no longer have the ability for foreigners to fund our consumption (via debt), we must start saving again. Printing money doesn't work.

Additionally, our stock market isn't based on real fundamentals. Foreigners have been taking their dollars from exports and reinvesting into American capital markets. If we reduce our need to import, inbound capital flows will slow. Stock market growth is largely tied to government spending growth and inflation. Don't believe me? Gold, which is an asset that has no "earnings," and is a much sounder money than the dollar, has outpaced the S&P 500 since 2004.

The old playbook of risking 6% of each paycheck into a tax-deferred account that you can't touch until retirement, while financing your largest expenditures (housing, vehicles, education, and healthcare) is no longer going to work. This new Era is going to be based on saving your capital and using it to drive American productivity.

Infinite Banking: The Modern Wealth Strategy

This new Era demands that Americans return to being producers, not dependents—of foreign capital, government handouts, or inflation-fueled markets. The party's over. If America wants to thrive again, it must fund its own future. That starts with individuals doing the same.

When we say “saving,” we’re not talking about locking money away in a bank account for 40 years, hoping for a better retirement. We’re talking about reclaiming financial sovereignty. Infinite Banking empowers you to become your own source of capital—your own banker—so you no longer have to beg institutions for access to your own money or overpay to finance your life.

At its core, Infinite Banking is a system of building, protecting, and deploying wealth through a properly designed whole life insurance policy. It gives you:

Guaranteed growth

Tax-advantaged savings

The ability to borrow against your capital while it continues compounding

Conclusion

This isn't just smart finance—it’s economic patriotism. True capitalism (which we do not have) is effectively using empathy to resolve scarcity issues. By using a time-tested system to strengthen yourself, your family, and your business—without contributing to the debt-based, inflation-heavy system that's failing us, you can position yourself for the new Era.

You're not waiting for retirement. You're building real, accessible capital today—to invest in your business, cover major expenses, and create generational wealth. You’re not sitting on the sidelines—you’re financing the rebuild of America from the ground up.

Book a call with us here if you'd like to learn how to become your own banker.

Comments